Wealth Simple vs Neo

Where should you keep your money…we can tell you this much, not under your mattress.

We all know the typical outline of savings: save every penny, look for no fees, and save a minimum of 10% for emergencies…well what if everyone is offering no fees nowadays? What if there are multiple reward offers, and they’re all a little similar and a little different..how the heck do we choose? Well, we’ve decided to break it down for you. Forget traditional banks for the moment (we’ll give them the spotlight another time). Today we’re focusing on the ads that have been interrupting your IG scroll and are getting you to wonder, am I working for my money, or is my money working for me?

We’re focusing strictly on the new kids on the block, digital self-directed banking, and how to make the best decision for you.

We’ll break the following brands down and showcase what each company has to offer, but before we jump off the deep end, think about your priorities when it comes to Saving, Spending, Investing. The two we’ve seen pop up the most are WealthSimple and Neo. The biggest difference seems to be that Wealthsimple is focused on trading and investing, with savings on the back burner, while Neo is focused on your day-to-day banking, spending, and rewards, with no self-directed trading options.

Wealthsimples cash card (“Spend” account) is essentially just another debit visa, so if you’re already at a bank that offers a cashback program or 0% foreign exchange rate you’re better off staying where you are. This card could be beneficial for those of you who are looking for an additional benefit on your day-to-day spending, and a passive way to increase your investment opportunity through day-to-day transactions. As this is considered a cash card, it will not affect your credit score…negatively or positively, but more on credit scores and credit cards another day.

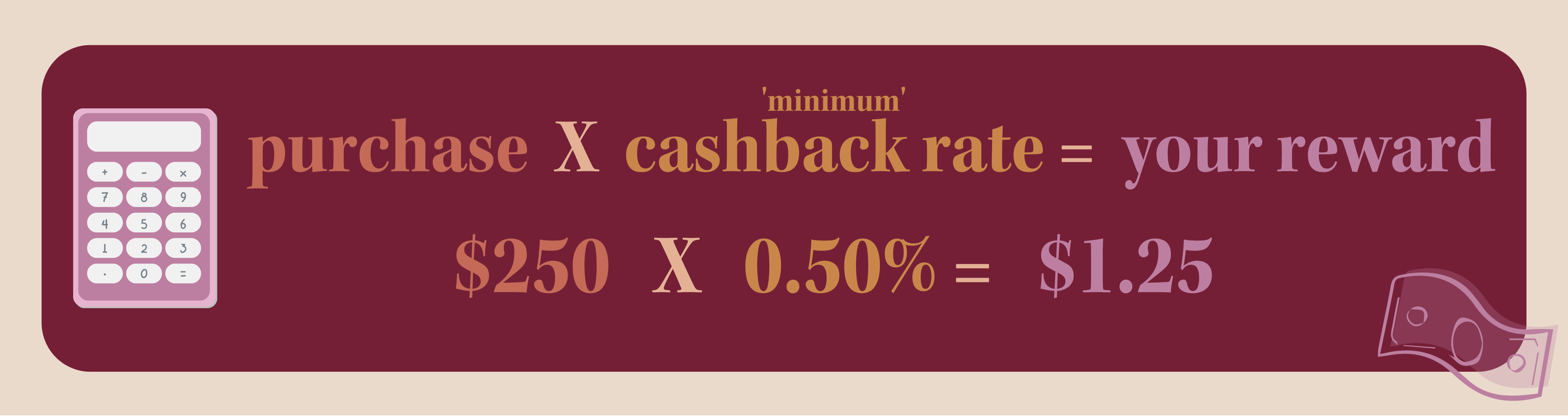

Neos credit card (“Card” account”) on the other hand is a true credit card, which will affect your credit score. While they claim to approve everyone, we dug a little deeper and noticed hidden in the T&Cs that some applicants may be required to provide security funds. The biggest draw to Neo is their cashback offer, which is guaranteed to earn you a minimum of 0.50% on each purchase → meaning, Neo will pay you at least 0.50% on each purchase even if the store isn’t a Neo cashback partner.

Important T&C to note, Neo will only pay the minimum up to a max of $50/month. That being said $50/month is pretty dang good- considering that would mean you’d be spending ~$10,000 a month at stores that aren’t Neo partners! Even better news, Neo is claiming ~5% average on these cashback rewards, and with the 8000 loyalty partners they advertise, chances are your rewards are going to be closer to that 5% reward.

Note from your fellow shopaholic: Don’t let this be an excuse to spend money on things you don’t need.

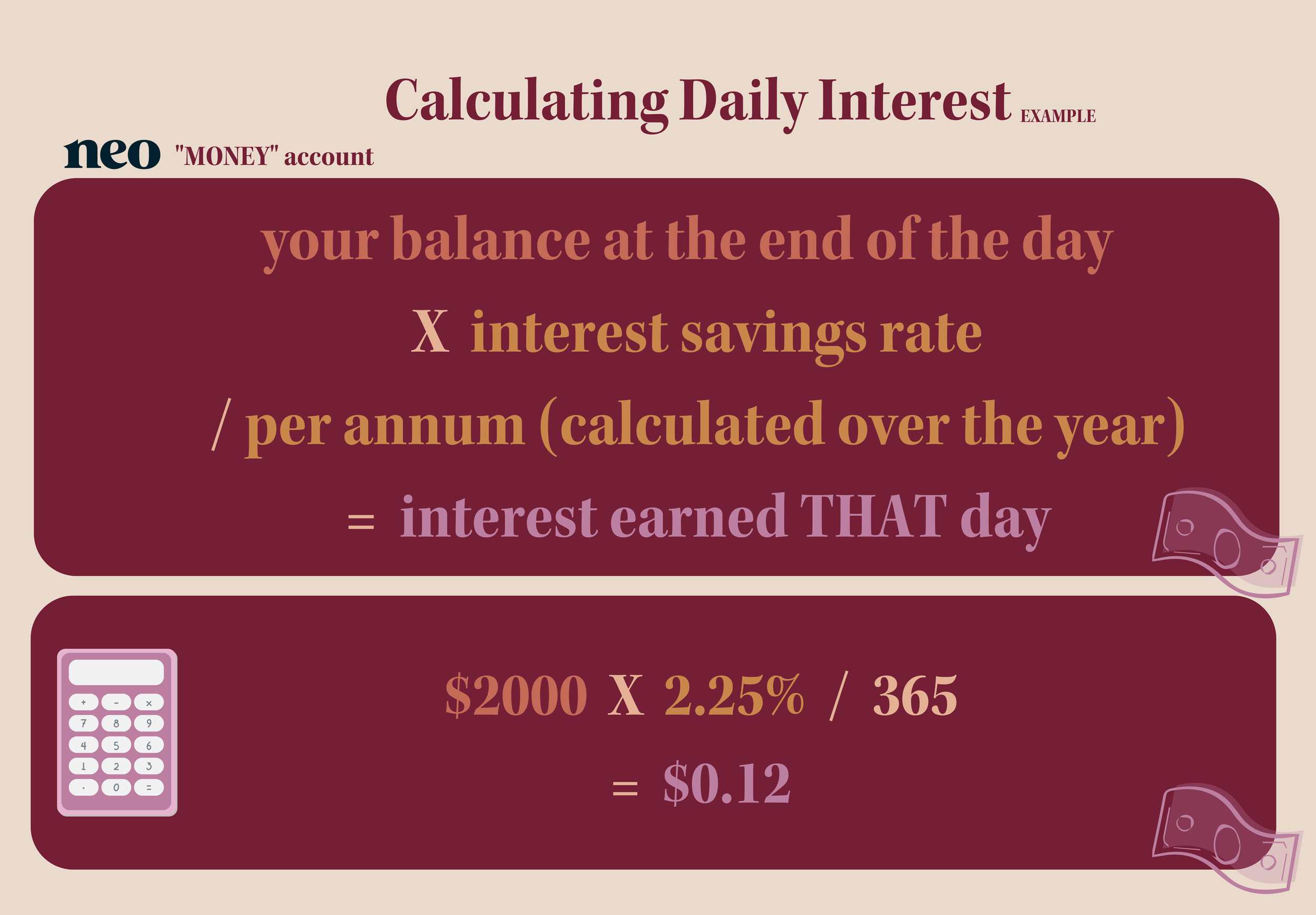

An additional offer from Neo is its banking x savings platform (“Money” account). It’s a hybrid savings & chequing account, which essentially means they offer unlimited free transactions and no minimums, which nowadays is a competitive standard. Where the savings component comes in is the interest they offer on the remaining balance. (We checked for any T&Cs and couldn’t find any). The interest rate is calculated at the end of each day, however, it’s paid out at the end of the month, which then if kept in the account will compound throughout the year…Free Christmas Presents Anyone?!

This account is great for those who are on a tight budget, and natural spenders who find it challenging to put away any extra pennies, as this allows you to make the most of what you DO have versus waiting until you flatline.

If you’re interested in going for one of these offers here’s what you should keep in mind, as a Jetsetter the WealthSimple Card would be a better fit for Holly and the Neo Card would be a better fit for Sam as she loves supporting locals. At the end of the day, it comes down to your personal goals, values, and more.

Now for you Blondies out there (myself included), this is a lot of words and math for my brain to wrap around in one go, so I asked my friend Sam finance expert to help us out with what she calls finances that makes sense.

So what the heck does this chart mean?

Let’s break it down even further! We’ll use Wealthsimple vs. Neo Financial, and look at their comparable Chequing Accounts:

*one final thought on the experience, you need to allow WealthSimple up to 5 Business Days to make the transaction from your original account to your wealth account, so it takes some budgeting to calculate the delay.

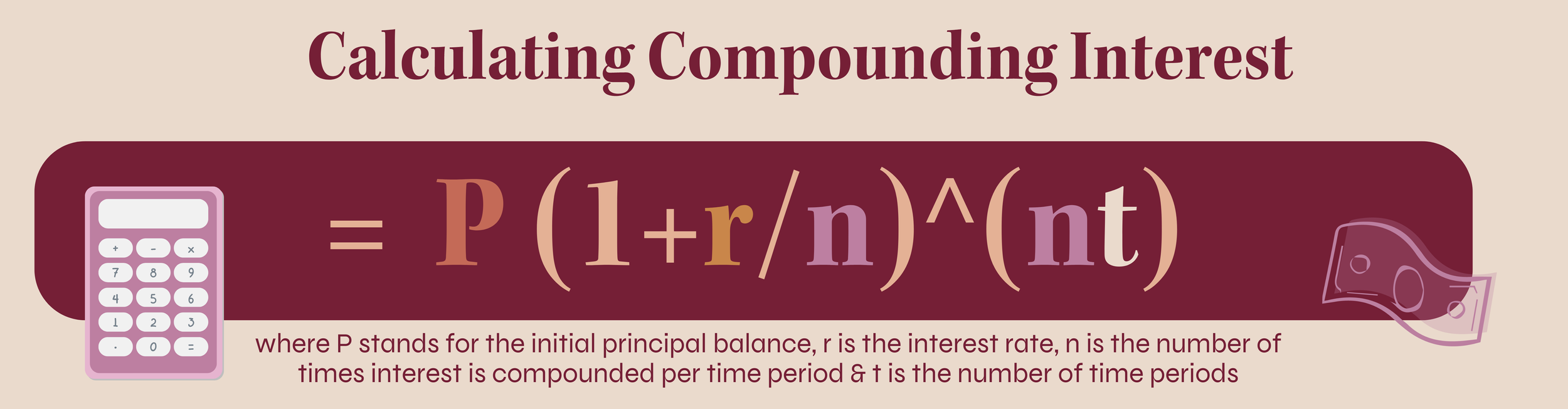

Understanding the power of Compounding Interest (growing your money!), using Neos MONEY account

*note, calculations assumed no change in daily closing balance, aside from the interest compounding impact- aka assumed no withdrawals or additional deposits other than depicted in the illustrations*

Let’s start with the daily interest, because even though it isn’t a sparkly amount, it always adds up:

Next up, calculating that compounding interest:

WTF, right? Rest assured, we’ll help cut through the noise: If you’re anything like us, and you’re a VISUAL person, this chart may help!

As you can see from the chart… the difference between no interest & Neo’s account, without any additional savings, isn’t significant. We’re talking $140 in interest over 3 years.If you’re looking for a place to park and grow more of your savings - this account isn’t designed for that. However, at the end of the day, the account is great no matter what because any growth is better than no growth, and earning interest on your day-to-day spending account is an A+ in our books.

Disclaimer, this is not advice, we just decided to do the hard work for you and make comparisons between the two offers. The rest is in your hands, all we ask is that if you decide to keep your money under the bed you keep it company with snacks.

Now, if you’re also a hands-on person, here are some compounding interest calculators we found online you can play with yourself:

https://www.thecalculatorsite.com/finance/calculators/daily-compound-interest.php

One last important point to mention when it comes to earning interest and growing your money, is to always be aware of the potential tax implications. For instance, any interest you earn >$50 in a year, is deemed taxable by the government. Now anything more on that topic is a whole can of worms we’ll have to get into another day.

We’re just scratching the surface on this topic, and we can’t wait to continue chatting! Be sure to sign up for emails so you don’t miss out on our latest news, blog posts, events and more!